From commodity to final product, Who Really Earns from Farming ?

Introduction: A Shocking Disparity

Every year, millions of tons of crops leave European farms. Wheat, carrots, potatoes, milk, lettuce... all grown with precision, resilience, and passion. And yet, one harsh reality remains: the value of these crops vanishes downstream. Somewhere between the field and the supermarket shelf, it evaporates.

This isn’t a new story. But it's increasingly unsustainable. And today, it’s no longer just a "farmers' issue" — it’s economic, political, and existential.

“In 2024, we sold a ton of wheat for around €180, which ends up transformed into flour and baguettes worth €3,600 — leaving us, the producer, with less than 5% of the final value. And it’s not just wheat. Cocoa farmers in West Africa face the same injustice: for every €1 chocolate bar you buy, less than €0.06 goes back to the person who grew the beans.

Every year, around harvest time, I find myself asking the same question: "Who’s really making money off the back of my father’s work? We take all the risks, we invest in expensive machinery and land, we do the hard work of growing — but others take the value.”

A Value Chain That Flows One Way

Let’s get real with the numbers.

Let’s take a simple example: common wheat. In 2024, the farmer earns around €200 per ton. By the time it becomes flour, it trades between €450–500 per ton, then goes on to become baguettes, pasta, breakfast cereal — you name it.

At that point, the final product has 10 times the value, and yet the farmer — the one who took all the risk — captures less than 10% of the final price.

Meanwhile, the grower deals with climate risks, input price volatility, unpredictable market dynamics, and strict quality requirements. And for all that? A shrinking share of the pie.

A ton of wheat yields about 750 kilograms of flour. With each baguette using 250 grams, that’s roughly 3,000 baguettesper ton of wheat.

At €1.20 per baguette, that gives a total retail value of €3,600 per ton of wheat — transformed and sold in pieces.

Yet, the farmer — the person who actually grew that wheat — receives only about €180 per ton on today’s market.

That’s exactly 5% of the final value, the rest disappears into the chain: logistics, processing, marketing, and retail.

Stage - Actor : Share of Final Value - €/Ton Equivalent

Raw Wheat Production - Farmer : 5% - €180/T

Storage & LogisticsCoop - Collectors : 8% - €180–€250/T

MillingFlour - Mill - 15–20% - €500–€700/T

Baking - TransformationBakery / Industrial Processor - 45–55% - €1,600–€1,800

Distribution - RetailSupermarkets / Shops - 15–25% - €540–€700

Taxes (VAT 5.5%) - Government : 5.5% - €198

Total—100% - €3,600

And It’s Not an Isolated Case

🥕 Carrots

Farmer paid: ~€0.30/kg

Retail price: ~€2.20/kg (washed, packed, labelled)

Producer share: ~14%

Even though the carrots are grown locally, the washing, sorting, packaging, and branding multiply their value by 7 — none of which returns to the field.

🍏 Apples

Farmer price: ~€0.50–€0.80/kg

Retail price : 2€-3€/kg or Rejected by co-ops for cosmetic reasons: “too small”, “not red enough”

Producer share: ~28%

🥛 Milk & Dairy Products

Raw milk paid: ~€0.40/L to the farmer (good price right now, it was paid at 0.20€/l few years ago)

Product - Retail Price - % of Raw Milk in Final Product - Farmer’s Share

1L Milk (UHT)~€1-1.20 - 100% - 35%

Yogurt (1 kg)~€3.50 - 90% (with culture, sugar)~12%

Butter (1 kg) - €10.00 - 22 L milk per kg → €9.24 - 9%

Cheese (e.g. Comté)- €15.00–€25.00/kg - 10 L milk per kg → €4.20 - 5–8%

🥩 Beef

Farmer price (live weight): ~€4.50/kg

Retail steak (transformed, cut, vacuum packed): €20–€40/kg

➡️ Producer share: ~15–20% of final price

Add a few labels ("matured", "grass-fed", "dry-aged") and the margin shifts entirely downstream — even though the biggest cost and effort lie in raising the animal.

More Processed Wheat Product : LU “Petit Beurre”

If you are not French, I am sure you don’t know that biscuit, but let’s say this biscuit is iconic for us and it is the simplest and healthiest you can find at the grocery store.

Raw Material Cost per Pack

Ingredient - Qty per pack - Price (€/kg) - Cost per pack

Wheat flour - 146g - €0.40/kg - €0.06

Sugar - 44g - €0.70/kg - €0.03

Butter - 26g - €10.00/kg - €0.26

Salt - 2g - €0.25/kg - <€0.01

Total Raw Cost——€0.35

Ingredients list

➡️ Cost of raw materials per kg: ~€1.75/kg

➡️ Final retail price: €5.40/kg

➡️ Share of value going to farmers: well under 5%

In a branded, processed cookie, the wheat becomes almost negligible. The value is captured by branding, processing, and retail — not by the origin of the grain.

What’s the lesson?

The more a product is processed, the more we pay for marketing, packaging and shelf stability — not for real nutrition or farmer income. We are paying for image and convenience, not for value or fairness.

And let’s be clear: the consumer has a role. Highly processed foods like this are loaded with sugar, fat and salt (and I'm not counting the chemical ingredients), often engineered to stimulate craving— not to nourish.

They cost far more than the sum of their parts, and they reward everyone but the one who grows the food.

€0.35 of ingredients, €1.08 at the shelf — and the farmer gets cents.

Hay harvesting 2023

Why This System is So Imbalanced

It’s tempting to think that this is just “how markets work.” But the current imbalance between the value created and the value captured by farmers is not inevitable. It’s the result of structural forces — economic, political, logistical — that have evolved to benefit those who operate downstream, not those who produce the raw value.

Here’s why farmers get squeezed, harvest after harvest:

1.Farmers are Fragmented, Buyers are Consolidated

Thousands of independent farmers negotiate with a handful of powerful buyers: millers, processors, industrial bakeries, food groups, and major retailers.

On one side: scattered producers, no pricing power.

On the other: vertically integrated giants with lawyers, lobbyists, data analysts.

This imbalance creates a structural power asymmetry. When market power is concentrated, pricing becomes centralized and strategic. When supply is fragmented, prices are dictated, not negotiated.

2. Transformation = Margin. And Farmers Don’t Control It.

The moment wheat leaves the farm, it enters a value chain where each step adds margin:

Milling → Processing → Baking → Packaging → Branding → Distribution → Retail.

But farmers?

They sell raw commodities — without control over transformation, product design, marketing, or shelf placement.

And in today’s food system, margin isn’t made by feeding people, it’s made by shaping perception.

3. Agricultural Products are Traded Like Oil, Not Valued Like Food

Cereals, milk, and even meat are treated as commodities, not as essential goods tied to real costs and local quality.

Wheat is priced like oil — on global exchanges.

A drought in Texas, or a rumor in Ukraine, can tank your price — even if your harvest is excellent.

Algorithms set the mood. Not agronomy.

Result: the price paid to farmers rarely reflects their actual cost of production, and often responds to events beyond their control.

4. Zero Transparency, Everywhere

Ask a consumer: how much of that €1.20 baguette goes to the farmer? Most don’t know — and no one is obliged to tell them.

There’s no breakdown of margins, no obligation to disclose purchase prices at retail level. Even inside co-ops or trading groups, the system is often opaque, with fees, blending, and bonuses masking the true farmgate price.

Transparency is only required when it serves someone else’s profit.

5. All the Risk is on the Farmer

Farmers pre-finance the entire production cycle: Seeds, fertilizer, crop protection, labor, insurance, machinery, land, and debt.

And yet:

They don’t set the selling price.

They don’t know it in advance.

They can’t guarantee margin.

They can’t pass on inflation.

They’re often paid last.

If yields collapse or prices crash — the farmer takes the hit. If yields soar or prices spike — someone else captures the value.

6. The Financialization of Food

Most of the major players downstream — Nestlé, Danone, Unilever, Mondelez, Carrefour, Walmart — are publicly traded companies. Their primary duty isn’t to nourish people or support farmers — it’s to maximize shareholder returns.

Their quarterly earnings are scrutinized by investment funds

Their margins are managed by financial engineers

Many use complex tax schemes, subsidiaries, and transfer pricing to minimize taxes and maximize dividends

When cost pressures rise? They pass it on to the consumer — or squeeze suppliers

Food has become a financial asset class. It’s not just about feeding people anymore — it’s about meeting growth targets.

And the closer you are to the land, the further you are from those profits.

In Summary

This isn’t just about bad luck or poor management. It’s a system that has been designed to externalize risk and internalize margin — all at the expense of the one person who makes food exist in the first place. We’ve turned farmers into price-takers, not price-makers.

How EU Cereal Growers Are Slowly Dying

From Many Small Farms to Fewer, Larger Ones

Over the past 60 years, Europe — and especially France — has seen a dramatic decline in the number of farms. In France, the number of agricultural holdings dropped from 2.3 million in 1955 to about 400,000 today. At the same time, the average farm size has more than doubled, from 28 hectares in 1988 to nearly 70 hectares in 2020. While this may sound like progress, the reality is far more complex.

France : On the left, evolutions of the number of farmers - On the right, Evolution of the area per farm (Total area used)

PRODUCTION COSTS HAVE GONE THROUGH THE ROOF

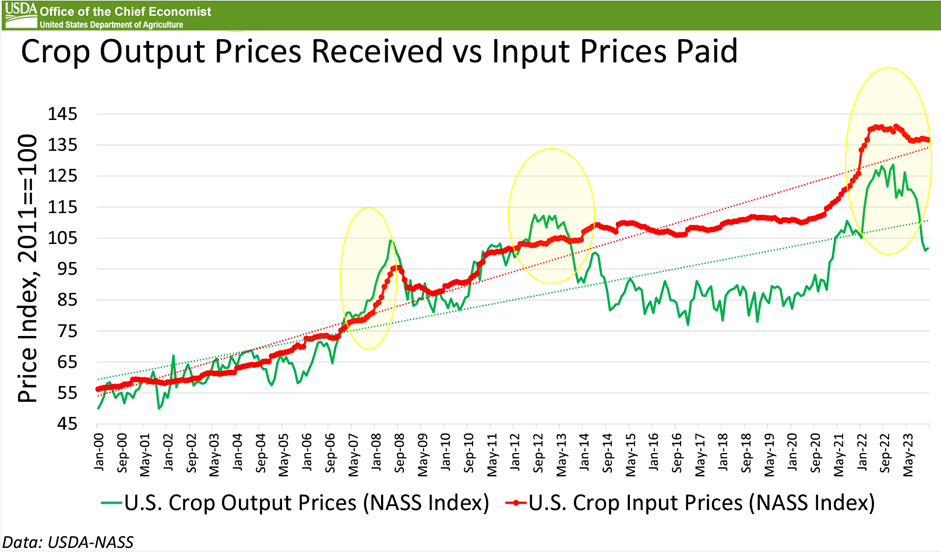

Let’s talk numbers. Over the last 20 years, almost every major input cost for EU cereal farmers has soared:

Agricultural land: Prices of arable land in France have nearly tripled (+150%) between 2000 and 2020. In 2024, average value reached €6,400/ha, up 3.2% over one year

Fertilizer costs (especially nitrogen-based) have surged, particularly post-2021. Between 2000 and 2022, fertilizer prices saw peaks of +200% in some cases.

Machinery & maintenance: +64% since 2003 — around 2.5% annual inflation, driven by complexity and regulation. Tractor power costs will rise from €500/horse (2000) to €1,200/hp (2024).

Seeds and crop protection: +7–10% since 2021, led by increasing biotech and regulatory costs

Land rent and energy have also become major financial drains. Fuel went from 0.3€/L (2000) to 1.1€/L (2025), +266% in 25 years.

Agricultural buildings: Construction costs for barns and stables have roughly doubled in the past 5 years, thanks to solar panel. Once again, the system takes advantage of farmers to double its prices and get the added value.

Now compare that with the price of wheat: since 2000, the average price of wheat in France has fluctuated but remained essentially flat when adjusted for inflation. It even declined in real terms from 1959 to 2009, with an average annual decrease of -3.3%. Yes, prices briefly spiked during the 2021–2022 crisis, but that was short-lived — and the relief didn’t last.

In short: production costs have climbed relentlessly, while crop prices have stagnated. Farmers are caught in a squeeze where even growing 10% more wheat often just means losing money 10% faster.

Input Costs vs. Wheat Prices & Yield Trends

While production costs have soared, wheat prices and yields haven't kept pace—leaving farmers with shrinking margins despite their hard work.

On the other hand, while yields rose between the 60s and 2000, they haven't improved since, and in fact the opposite is true. And I'm pretty sure it won't get any better in the years to come with global warming.

Source : https://uswheat.org/wheatletter/wheat-price-perspectives-a-look-at-long-term-trends/

Farmers are squeezed: production costs have jumped far faster than both prices and yields, compressing already thin margins into unviability.

Why Europe Can’t Scale Like Australia

Let’s kill the illusion: Europe is not Australia. Even as European farms grow in size, they simply cannot scale like their counterparts in Australia, the U.S., or South America. The reasons are structural. European land is highly fragmented due to centuries of inheritance laws and dense rural populations. Land ownership is tightly regulated, and access to additional hectares is increasingly difficult — both legally and financially.

While Australian cereal farms can reach thousands of hectares with minimal labor, European farmers are capped by geography, regulation, and urban pressure. Bigger equipment and more land help — but only up to a point. A 200-hectare wheat farm in France will never enjoy the same economies of scale as a 5,000-hectare operation in Western Australia. We’re playing a different game, on a different field, with different rules — and pretending otherwise is just accelerating the collapse.

Images generated with ChatGPT - We see an outrageous old farmer surviving on subsidies, being milked by the ecosystem

So, What Can Be Done to Save EU cereals Farmers?

The current system locks large EU cereal growers into a trap: scale up, invest more, and pray for a decent margin. It's an exhausting treadmill. Breaking free from this cycle requires more than just good intentions — it calls for strategic reinvention. Here are three actionable paths forward, each with its own opportunities and challenges.

1. Reinvest in Local Transformation

Rather than exporting low-value raw materials, why not process them locally and capture more of the value chain? Shared investments in tools like mills, oil presses, cutting rooms, or canning facilities can boost margins, create local jobs, and shorten supply chains.

The challenge: Upfront investment is high, sanitary regulations are strict, and selling in short or mid-length supply chains requires commercial know-how and time.

2. Upgrade Quality — But Only If It Pays

Switching to organic, regenerative, or certified high-quality farming can improve margins — but only if the market rewards the effort. To succeed, farmers need to escape the anonymity of bulk commodities and build a product identity and story.

The challenge: Without direct access to consumers or strong branding support, quality alone doesn't guarantee higher income. The “quality premium” can quickly erode in saturated markets, that’s what we saw with the organic EU production rising in the last 10 years, but has been declining since the end of covid.

3. Redesign Cooperatives as Power Brokers

Today, many cooperatives operate like commercial middlemen or storage facilities. But they should act as value aggregators: negotiating better prices, investing in shared transformation tools, and strengthening collective economic power.

A cooperative should be more than just a grain silo — it should be a margin creator and a cost breaker.

The challenge: This requires deep changes in governance, culture, and strategic priorities. And often, a fight against vested interests who benefit from the current setup.

4. Demand Transparency — Everywhere

Who earns what along the agri-food chain? Too often, profits are hidden behind complex contracts and opaque structures. Economic transparency (not just food traceability) is key to rebalancing power.

The challenge: It demands strong political will and collective (customers) pressure, because dominant players have every reason to keep the margins hidden.

5. Shift the Consumer Mindset

As long as most consumers continue to buy ultra-processed, heavily marketed food at the lowest possible cost, fair farmer pay will remain out of reach. Rediscovering simpler, raw, and locally sourced food isn’t just a lifestyle choice — it’s a political and economic act.

But it also requires a deeper cultural shift: we must give food back the place it deserves. Over the past 50 years, both the time and budget dedicated to eating — real, nourishing food — have steadily declined. Meanwhile, spending on entertainment, digital services, and travel has soared. This isn’t without consequence: rising rates of obesity, heart disease, and mental fatigue point to a deeper societal imbalance.

The challenge: Changing consumer habits is slow. Without proper education, meaningful alternatives, and a cultural revalorization of food, many will remain trapped in the cheap-food loop — unaware of what’s truly at stake on their plate.

And You, Would You Work for 5% of What You're Worth?

Let’s put things in real terms.A typical French employee earns €2,000 net per month. Now imagine your payslip shows something else too: the actual value you generate for your company — €40,000. And now imagine the fine print says:

“You only receive 5% of the value you create. But you also need to buy your own tools, pay the energy and infrastructure bills in advance, and assume all the financial risks. The other 95%? It goes to your boss, your supplier, your customer and the logistics chain.”

Would you still show up every morning? Would you invest in training, in new equipment, or put in overtime?

Because that’s the deal cereal farmers get — every year, every harvest.

What about on our family farm ?

Let’s take our own family farm as an example. Each year, we produce:

300 tonnes of malting barley

Malt yield: 300 t ÷ 1.3 ≈ 230 t of malt

At about 8,837 L of beer per tonne of malt: 2,035,000 L of beer

At an average retail price of €1.50 per liter, that’s ≈ €3 million in consumer sales

150 tonnes of rapeseed

Yield: roughly 0.4 L oil per kg → 60,000 L of oil

At €1.80/L, that equates to €108,000 in revenue

600 tonnes of wheat

Standard baguette: ~250 g each → 2.4 million baguettes

At €1.20 per baguette, total consumer value ≈ €2.9 million

These raw materials power a value chain worth millions of euros — for breweries, food brands, retailers, and logistics platforms. Yet the farmer who grows it all ? He keeps barely 5% of that final value. Often less.

We don’t need to wait for famine, food riots, or a full-blown political crisis to wake up. Because if we do, the reaction won’t be orderly — and it won’t be fair. Let’s rebuild value where it’s created. Now. Before we no longer can.

Want to learn more about my vision on automatization and robots ? Contact me on my socials !

Hay harvest 2023

The road to successful development of an AgTech solution

Ep 0/7 : IS THE AGTECH INDUSTRY IN CRISIS ?

Ep 1/7 : HOW TO SUCCESSFULLY POSITION YOUR PRODUCT IN THE AGRICULTURAL MARKET?

Ep 2/7 : HOW TO ADAPT YOUR AGRICULTURAL MACHINES TO MARKET AND CUSTOMER NEEDS?

Ep 3/7 : MAKING A SUCCESS OF YOUR FIRST PILOT PROJECTS WITH FARMERS

Ep 4/7 : MAXIMIZE THE RETURN ON INVESTMENT (ROI) OF YOUR AGTECH SOLUTIONS !

Ep 6/7 :OPTIMIZING PRODUCT SCALING THROUGH FINAL USER FEEDBACK

Want to learn more about Agtech opportunities ?

AMERICAN MARKET - 🇺🇸

AUSTRALIAN MARKET - 🇦🇺

CALIFORNIAN MARKET - 🇺🇸

CANADIAN MARKET - 🇨🇦

EUROPEAN MARKET - 🇪🇺

FRENCH MARKET - 🇫🇷